Understanding financial aid disbursement dates for the 2023-2024 academic year is crucial for students and families to manage educational expenses effectively․ These dates vary by institution but typically occur around the start of each term, such as September for fall and January for spring semesters․ Disbursements depend on factors like enrollment status, aid type, and institutional policies․ Staying informed helps students plan financially and avoid delays in receiving funds․

1․1 Understanding the Importance of Financial Aid Disbursement Dates

Financial aid disbursement dates are critical for students to plan their academic and living expenses․ These dates determine when funds are released, ensuring timely payment of tuition and fees․ Understanding disbursement schedules helps students budget effectively, avoid delays, and comply with institutional policies․ Staying informed about these dates is essential for managing financial responsibilities and ensuring uninterrupted access to educational resources throughout the academic year․

1․2 Key Terms and Concepts Related to Financial Aid Disbursement

Key terms include disbursement date, the day funds are released; Expected Family Contribution (EFC), determining eligibility; Pell Grant, a need-based grant; FAFSA, the application for federal aid; and loan period, the timeframe for loan disbursement․ Understanding these concepts helps students navigate the financial aid process effectively and ensure timely receipt of funds for their education․

Federal Financial Aid Disbursement Dates for 2023-2024

Federal financial aid disbursements for 2023-2024 typically begin 10 days before the term starts, with exact dates varying by institution․ Key programs include Pell Grants and federal loans, with disbursements tied to enrollment status and institutional policies․ Students should check their school’s calendar for specific federal aid release dates to plan accordingly․

2․1 Pell Grant Disbursement Schedule for 2023-2024

The Pell Grant disbursement schedule for 2023-2024 varies by institution but typically aligns with the academic term start dates․ The maximum Pell Grant award is $7,395, with disbursements occurring after tuition fees are paid․ Fall 2023 disbursements generally begin in September, while spring 2024 disbursements start in January․ Exact dates depend on institutional policies and student enrollment status․

2․2 Federal Student Loan Disbursement Timeline

Federal student loans are typically disbursed 10 days before the semester starts, aligning with the academic calendar․ Processing begins 15 days prior to the disbursement date․ For the 2023-2024 academic year, fall disbursements generally occur in late August or early September, with spring disbursements in late December or early January․ Completing the FAFSA by the deadline ensures timely processing․

Institutional Financial Aid Disbursement Policies

Institutional financial aid disbursement policies vary by school, often aligning with academic terms․ Schools set specific dates based on enrollment and program length, ensuring funds are available when needed․

3․1 How Colleges and Universities Determine Disbursement Dates

Colleges and universities determine disbursement dates based on factors like enrollment status, program length, and academic calendars․ Processing begins 15 days before disbursement, with funds released after verifying eligibility․ Institutions align disbursements with term starts, ensuring timely access to funds․ Variations occur based on program structure and institutional policies, helping students plan accordingly․

3․2 Variations in Disbursement Schedules Across Institutions

Disbursement schedules vary widely across institutions due to differences in institutional policies, academic calendars, and program-specific requirements․ Some schools disburse funds per class or term, while others align disbursements with the start of each academic session․ Additionally, refund dates and summer session disbursements differ, reflecting each institution’s unique financial aid policies and operational timelines․

FAFSA and Financial Aid Eligibility for 2023-2024

Completing the FAFSA early is essential for determining financial aid eligibility․ Submission deadlines and verification processes impact disbursement timing, ensuring accurate award calculations for the academic year․

4․1 FAFSA Deadlines and Their Impact on Disbursement Dates

FAFSA deadlines significantly influence financial aid disbursement dates․ Submitting the FAFSA by the federal, state, or institutional deadline ensures timely processing․ Late submissions may delay disbursement, affecting academic planning․ For the 2023-2024 cycle, the FAFSA opened on October 1, 2022, with a June 30, 2024, federal deadline․ Meeting these dates is crucial for receiving aid on schedule․

4․2 Verification Process and Its Role in Disbursement Delays

The verification process ensures FAFSA accuracy but can delay disbursement if not completed promptly․ Schools may request additional documents to verify data, and disbursement cannot occur until verification is complete․ Delays often arise if students fail to submit required documents quickly․ Timely submission of verification materials is essential to avoid late financial aid disbursement․

Disbursement Dates for Specific Academic Terms

Disbursement dates vary by term and institution․ Fall 2023 typically starts in early September, with spring 2024 in January; Check your school’s portal for exact dates․

5․1 Fall 2023 Disbursement Dates and Procedures

Fall 2023 disbursement dates typically begin in late August or early September, aligning with the start of classes․ Exact dates vary by institution, but funds are usually released after enrollment is confirmed․ Students must ensure all required documents are submitted and eligibility criteria are met․ Check your school’s financial aid portal for specific dates and procedures to avoid delays․

5․2 Spring 2024 Disbursement Dates and Refund Policies

5․3 Summer 2024 Disbursement Dates and Eligibility

Summer 2024 financial aid disbursements typically begin in early June, with eligibility based on enrollment status․ Students must be enrolled at least half-time for federal loans and Pell Grants․ Summer Pell Grants are limited to students with remaining eligibility, while SEOG funds are awarded if available․ Check your school’s summer session policies for specific dates and refund timelines․

Refunds and Financial Aid Disbursement

Refunds occur after financial aid is disbursed and applied to tuition․ Federal regulations require disbursements to be processed within specific timelines, ensuring timely fund availability․

6․1 How Refunds Are Processed After Disbursement

Refunds are issued after financial aid is applied to tuition and fees․ Excess funds are disbursed to students, typically within 14 days of disbursement․ The Bursar’s office processes refunds, ensuring timely delivery․ Students receive refunds via direct deposit or check, depending on institutional policies․ Exact dates vary by school but generally align with term start dates․

6․2 Anticipated Refund Dates for 2023-2024

Refunds for the 2023-2024 academic year are anticipated to be issued shortly after disbursement․ Fall 2023 refunds are expected around mid-September, spring 2024 refunds in early January, and summer 2024 refunds in late May or June․ Exact dates vary by institution but are typically communicated in advance․ Students should verify specific dates with their school’s financial aid office or portal for the most accurate information․

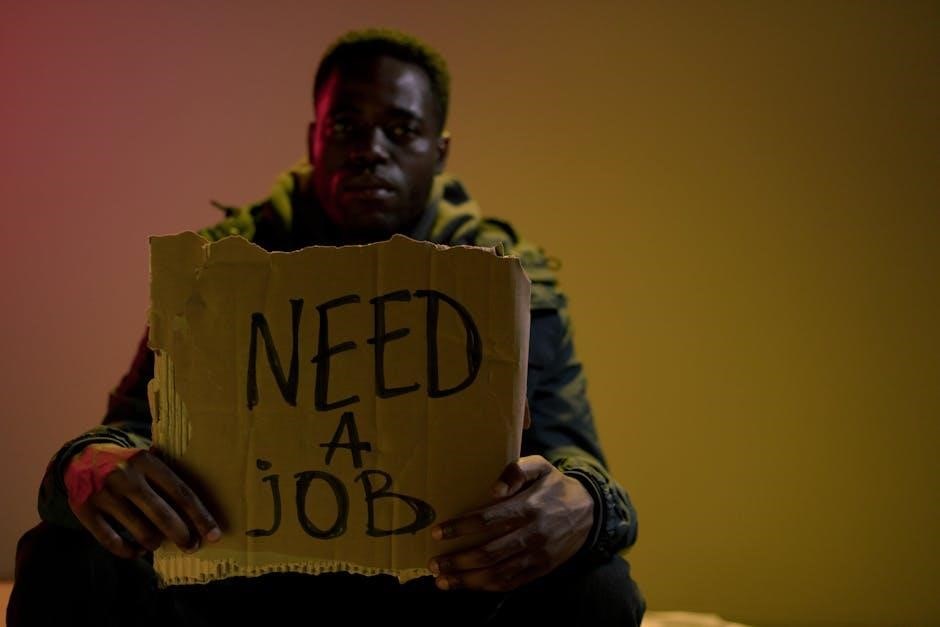

Impact of Enrollment Changes on Financial Aid Disbursement

Changes in enrollment, such as dropping courses or withdrawing, can impact financial aid disbursement, potentially requiring repayment of funds․

7;1 Effects of Dropping Courses on Financial Aid

Dropping courses can significantly impact financial aid eligibility, potentially reducing awards or requiring repayment of disbursed funds․ Enrollment status changes, such as falling below half-time, may trigger aid adjustments․ Timing of drops also matters; dropping before disbursement may avoid repayment, while dropping after may necessitate it․ Always consult your school’s financial aid office to understand specific policies and avoid unexpected repayment obligations․

7․2 Withdrawal Policies and Financial Aid Adjustments

Withdrawing from school may require repayment of disbursed financial aid funds․ The return of unearned aid is calculated based on the percentage of the term completed․ Withdrawal impacts future aid eligibility and may delay disbursement in subsequent terms․ Students must review institutional refund policies and consult the financial aid office to understand potential adjustments and repayment obligations․

Recent Changes in Financial Aid Disbursement for 2023-2024

The 2023-2024 academic year introduced updates to Pell Grant awards, with disbursements now based on enrollment percentages․ Additionally, new FAFSA changes aim to simplify the application process․

8․1 Updates to Pell Grant Awards for 2023-2024

The maximum Pell Grant award for 2023-2024 is $7,395, with disbursements based on enrollment percentages․ The minimum award is 10% of the maximum, and eligibility is determined by EFC (Expected Family Contribution) up to $6,656․ Starting in 2024-2025, disbursements will align with program length, affecting loan limits․ These changes aim to enhance accessibility and fairness in federal aid distribution․

8․2 New FAFSA Changes and Their Impact on Disbursement

The 2024-2025 FAFSA opened earlier, in December 2023, with significant changes affecting disbursement timelines․ These include updates to family contribution calculations and Expected Family Contribution (EFC) considerations․ The new FAFSA also emphasizes early submission and verification processes to maximize aid eligibility․ Students should complete their FAFSA promptly and monitor institutional policies for specific disbursement impacts, as changes may vary by school․

Institutional Disbursement Policies for 2023-2024

Institutional disbursement policies vary by school, with specific dates for fall, winter, spring, and summer terms․ Students should check their school’s financial aid calendar for details․

9․1 School-Specific Disbursement Dates and Procedures

Schools set their own disbursement dates, varying by institution and term․ For the 2023-2024 academic year, disbursements typically occur 10 days before each term starts․ Fall disbursements often begin in late August or early September, while spring disbursements start in January․ Summer sessions may have multiple disbursement dates depending on the program length․ Students should check their school’s financial aid portal for exact timelines and procedures to ensure funds are received promptly․

9․2 Examples of College and University Disbursement Calendars

Colleges like Dallas College and SUNY Schenectady provide detailed disbursement calendars․ For the 2023-2024 academic year, Dallas College lists fall disbursements starting September 17, 2024, while SUNY Schenectady may begin earlier․ Summer sessions often have staggered dates based on program length․ Institutions publish these calendars on their financial aid websites, ensuring students can plan accordingly․ Always verify dates with your school, as timelines may vary․

Student Responsibilities and Financial Aid Disbursement

Students must monitor their financial aid status, complete required documents, and ensure eligibility criteria are met․ Regularly checking school portals and emails is essential for timely disbursement․

10․1 Monitoring Financial Aid Status and Disbursement Dates

Students must actively monitor their financial aid status through their school’s portal and emails․ Regular checks ensure timely addressing of issues, verification requests, and disbursement updates․ Monitoring helps students stay informed about their aid eligibility, disbursement schedules, and any required actions․ This proactive approach prevents delays and ensures funds are received as expected for the academic term․

10․2 Required Actions for Receiving Financial Aid

Students must complete all required actions to ensure timely disbursement of financial aid․ This includes submitting necessary documents, maintaining satisfactory academic progress, and confirming enrollment status․ Additionally, students must review and accept loan terms if applicable․ Failure to complete these steps may delay or prevent aid disbursement, impacting academic and financial planning for the term․

FAQs About Financial Aid Disbursement Dates 2023-2024

FAQs address common questions about disbursement timing, troubleshooting delays, and eligibility requirements, providing clarity for students and families navigating financial aid processes effectively․

11․1 Common Questions About Disbursement Timing

Common questions include when disbursements occur, factors affecting timing, and how to check status․ Disbursements typically start before classes, vary by aid type, and require completed FAFSA․ Pell Grants and loans have different schedules; Students often ask about delays due to verification or enrollment changes․ Checking the institution’s portal and contacting the financial aid office are recommended for updates․

11․2 Troubleshooting Disbursement Delays

Delays often occur due to incomplete FAFSA, verification issues, or enrollment changes․ Students should ensure all documents are submitted and verify enrollment status․ Contacting the financial aid office promptly can resolve issues․ Monitoring institutional portals for updates and confirming aid eligibility are key steps to address delays and ensure timely disbursement of funds․

Understanding financial aid disbursement dates is crucial for managing educational expenses․ For more details, refer to the FSA Handbook or your institution’s official financial aid website․

12․1 Summary of Key Points

The 2023-2024 financial aid disbursement dates vary by institution and aid type, with Pell Grants and loans typically disbursed near term starts․ FAFSA deadlines and verification processes impact timing․ Enrollment changes and institutional policies can affect disbursement amounts․ Staying informed and monitoring accounts ensures smooth financial planning for students․

12․2 Where to Find More Information on Financial Aid Disbursement

For detailed information on financial aid disbursement dates, visit the FAFSA website or your institution’s financial aid office․ Check your school’s portal, such as MyChaffeyPortal, for specific disbursement schedules․ Additionally, resources like the Federal Student Aid Handbook and your college’s financial aid webpage provide comprehensive guides and updates on disbursement processes․