Power XL Air Fryer Instructions: A Comprehensive Guide

Discover effortless cooking with your Power XL Air Fryer! This guide covers setup, operation, cleaning, and troubleshooting for models MFC-AF-6, MFC-AF-6C, and MFC-AF-8.

Understanding Your Power XL Air Fryer

Your Power XL Air Fryer is a versatile kitchen appliance designed for quick and healthy cooking. Utilizing hot air circulation, it mimics the results of deep frying without excessive oil, offering a healthier alternative for enjoying your favorite foods. This appliance isn’t just for “frying” – it roasts, bakes, and reheats with impressive efficiency.

Understanding the core functionality is key to maximizing its potential. The air fryer works by rapidly circulating hot air around the food, creating a crispy exterior and tender interior. Different models – MFC-AF-6 (6QT), MFC-AF-6C (6QT), and MFC-AF-8 (8QT) – offer varying capacities to suit different household sizes and cooking needs. Familiarizing yourself with these basics will unlock a world of culinary possibilities.

Model Variations & Identification (MFC-AF-6, MFC-AF-6C, MFC-AF-8)

Power XL Air Fryers come in several variations to cater to diverse cooking requirements. The MFC-AF-6 and MFC-AF-6C are both 6-quart models, ideal for smaller families or individuals. The primary difference between these two lies in subtle design features and potentially bundled accessories – consult your packaging for specifics.

For larger households or those who frequently entertain, the MFC-AF-8 offers an 8-quart capacity, providing ample space for cooking bigger portions. Identifying your specific model is crucial for accessing the correct user manual and troubleshooting information. Locate the model number on the appliance’s base or in the original documentation. Knowing your model ensures optimal performance and safety.

Initial Setup & First Use

Before your first use, unpack your Power XL Air Fryer and remove all packaging materials. Wash the basket and any included accessories with warm, soapy water; ensure they are completely dry before use. Place the air fryer on a stable, heat-resistant surface with adequate ventilation.

Plug in the appliance and familiarize yourself with the control panel. It’s recommended to perform a test run by preheating the air fryer to 400°F (200°C) for 3-5 minutes. This helps eliminate any residual manufacturing odors. During this initial burn-off, a slight smell may be present – this is normal. Your Power XL Air Fryer is now ready for delicious, crispy cooking!

Control Panel Overview & Functions

The Power XL Air Fryer’s control panel features intuitive buttons for effortless operation. Typically, you’ll find power, temperature, and timer controls. Preset functions like ‘Fry,’ ‘Roast,’ ‘Bake,’ and ‘Reheat’ offer convenient one-touch cooking. Use the temperature controls to adjust the cooking heat, usually ranging from 180°F to 400°F (82°C to 204°C).

The timer allows precise cooking duration settings. Some models include digital displays for accurate temperature and time monitoring. Explore the manual to understand specific button functions for your model (MFC-AF-6, MFC-AF-6C, or MFC-AF-8). Familiarizing yourself with these controls unlocks the full potential of your air fryer.

Essential Cooking Features

The Power XL Air Fryer excels at rapid air circulation, delivering crispy textures with minimal oil. Its versatile cooking modes – Fry, Roast, Bake, and Reheat – cater to diverse culinary needs. Enjoy healthier versions of fried favorites, perfectly roasted meats, and evenly baked goods.

Accessories like racks, skewers, and baking pans expand cooking possibilities. Preheating ensures optimal results, while adjustable temperature and time settings provide precise control. This appliance simplifies meal preparation, offering convenience and efficiency. Models MFC-AF-6, MFC-AF-6C, and MFC-AF-8 share these core features, making air frying accessible to everyone.

Preheating the Air Fryer

Proper preheating is crucial for achieving optimal cooking results with your Power XL Air Fryer. Most recipes benefit from a 3-5 minute preheat cycle at the desired cooking temperature. This ensures the heating element is fully heated, promoting even cooking and superior crisping.

For best results, preheat the air fryer empty before adding food. Some models may have a dedicated preheat function; otherwise, simply set the temperature and time, and allow it to warm up. Preheating is particularly important for foods requiring a crispy exterior, like fries or chicken. Models MFC-AF-6, MFC-AF-6C, and MFC-AF-8 all benefit from this step.

Temperature & Time Settings

Mastering temperature and time is key to successful air frying with your Power XL. The air fryer typically operates between 170°F and 400°F (77°C and 204°C). Cooking times vary significantly based on the food type and quantity. Always refer to recipes for specific guidance, but start with recommended settings and adjust as needed.

For models MFC-AF-6, MFC-AF-6C, and MFC-AF-8, the control panel allows precise adjustments. Lower temperatures are ideal for delicate foods, while higher temperatures create crispier results. Shaking or flipping food halfway through cooking ensures even browning. Experimentation is encouraged to find your preferred settings!

Common Cooking Modes (Fry, Roast, Bake, Reheat)

Your Power XL Air Fryer boasts versatile cooking modes for diverse culinary creations. The ‘Fry’ mode excels at achieving crispy textures with minimal oil, perfect for fries, chicken, and more. ‘Roast’ delivers succulent results for meats and vegetables, mimicking traditional oven roasting. ‘Bake’ allows you to create cakes, cookies, and other baked goods with ease.

The ‘Reheat’ function revitalizes leftovers, restoring their original crispness and flavor. Each mode offers pre-programmed temperature and time settings, but customization is always possible. Explore these modes to unlock the full potential of your MFC-AF-6, MFC-AF-6C, or MFC-AF-8 model!

Cooking with the Power XL Air Fryer

To begin, ensure your Power XL Air Fryer is properly preheated for optimal results. Arrange food in a single layer within the basket or on an accessory rack – avoid overcrowding for even cooking. Regularly shake or flip food halfway through the cooking process, promoting consistent crisping.

Utilize recommended cooking times and temperatures as a starting point, adjusting as needed based on your preferences and the specific food item. Experiment with marinades and seasonings to enhance flavor. Remember to check for doneness using a food thermometer, ensuring safe and delicious meals with your MFC-AF-6, MFC-AF-6C, or MFC-AF-8!

Recommended Cooking Times & Temperatures for Popular Foods

For crispy French fries, air fry at 400°F (200°C) for 15-20 minutes, shaking halfway through. Chicken wings achieve optimal crispness at 380°F (190°C) for 20-25 minutes, flipping once. Salmon fillets require approximately 10-12 minutes at 375°F (190°C).

Vegetables like broccoli and Brussels sprouts benefit from 390°F (200°C) for 8-10 minutes. Remember these are guidelines; adjust times based on your Power XL model (MFC-AF-6, MFC-AF-6C, MFC-AF-8) and desired level of doneness. Always verify internal temperatures for food safety. Experimentation is key to mastering your air frying technique!

Using Accessories (Racks, Skewers, Baking Pan)

Enhance your Power XL Air Fryer’s versatility with included accessories! The racks are ideal for maximizing cooking space and achieving even crisping for items like chicken or vegetables. Skewers are perfect for kebabs, ensuring 360-degree cooking.

The baking pan is suited for cakes, muffins, or reheating casseroles. When using accessories, avoid overcrowding the basket for optimal air circulation. Ensure accessories are securely placed before operation, compatible with your model (MFC-AF-6, MFC-AF-6C, MFC-AF-8), and cleaned thoroughly after each use. Proper accessory use unlocks a wider range of culinary possibilities!

Tips for Crispy & Even Cooking

Achieve restaurant-quality results with these simple tips! Don’t overcrowd the basket – air needs to circulate for even crisping. For extra crunch, lightly coat foods with oil before air frying. Shake or flip food halfway through the cooking process, especially for models MFC-AF-6, MFC-AF-6C, and MFC-AF-8.

Preheating ensures optimal temperature from the start. Consider marinating or seasoning foods for enhanced flavor. Layering food strategically maximizes space, but avoid blocking airflow. Experiment with different temperatures and times to find what works best for your favorite recipes.

Cleaning & Maintenance

Regular cleaning ensures optimal performance and longevity of your Power XL Air Fryer (models MFC-AF-6, MFC-AF-6C, MFC-AF-8). Always unplug the unit and allow it to cool completely before cleaning. The basket and crisper plate are dishwasher safe for convenient cleaning.

For the interior and exterior, wipe down with a damp cloth and mild detergent. Avoid abrasive cleaners that could damage the surface. Preventative maintenance includes checking for food debris after each use. Proper care extends the life of your appliance and maintains food safety.

Disassembling & Washing Components

To begin cleaning, carefully remove the basket and crisper plate from your Power XL Air Fryer (models MFC-AF-6, MFC-AF-6C, MFC-AF-8). These components are typically dishwasher safe, offering a convenient cleaning solution. Ensure they are securely placed to prevent movement during the wash cycle.

The exterior housing can be wiped down with a damp cloth and mild dish soap. Avoid immersing the main unit in water. Thoroughly dry all parts before reassembling. Regular disassembly and washing prevent buildup and maintain optimal performance, ensuring hygienic food preparation.

Cleaning the Interior & Exterior

Maintaining a clean Power XL Air Fryer (MFC-AF-6, MFC-AF-6C, MFC-AF-8) is crucial for optimal performance and food safety. After each use, allow the unit to cool completely before cleaning. The interior can be wiped down with a damp, soapy cloth to remove any food residue. Avoid abrasive cleaners, which can damage the non-stick coating.

For the exterior, use a soft cloth dampened with mild detergent. Never immerse the main unit in water or any liquid. Ensure all components are thoroughly dried before reassembly. Regular cleaning prevents grease buildup and ensures hygienic cooking for years to come.

Preventative Maintenance Tips

To ensure the longevity of your Power XL Air Fryer (models MFC-AF-6, MFC-AF-6C, MFC-AF-8), implement these preventative measures. Regularly inspect the power cord for damage and avoid using it if frayed. After each use, wipe down the interior and exterior to prevent grease buildup. Periodically check the heating element for any signs of wear or damage.

Proper ventilation is key; ensure the air fryer isn’t blocked during operation. Avoid overfilling to prevent splatter and maintain efficient airflow. Consistent cleaning and careful handling will keep your air fryer functioning optimally for countless meals.

Troubleshooting Common Issues

If your Power XL Air Fryer (MFC-AF-6, MFC-AF-6C, MFC-AF-8) isn’t heating, verify the power cord is securely plugged in and the outlet is functioning. For uneven cooking, ensure food isn’t overcrowded and is arranged in a single layer. Regularly check and clean the heating element for buildup.

Should you encounter error codes, consult the user manual for specific meanings and solutions. Proper ventilation and avoiding overfilling can prevent many issues. If problems persist, discontinue use and contact customer support for assistance. Consistent maintenance minimizes potential malfunctions.

Air Fryer Not Heating

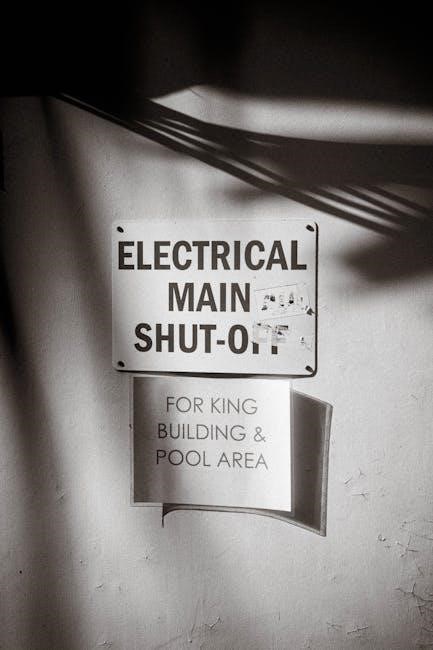

If your Power XL Air Fryer (models MFC-AF-6, MFC-AF-6C, MFC-AF-8) fails to heat, first confirm the unit is properly plugged into a working electrical outlet. Inspect the power cord for any visible damage. Ensure the basket is fully inserted, as a safety mechanism prevents operation when open.

Verify the timer is set and the desired temperature is selected. A reset of the appliance might resolve minor glitches. If the issue continues, check the heating element for obstructions or buildup. Contact customer support if these steps don’t restore heating functionality.

Food Not Cooking Evenly

Uneven cooking in your Power XL Air Fryer (MFC-AF-6, MFC-AF-6C, MFC-AF-8) often stems from overcrowding the basket. Ensure food is arranged in a single layer, allowing hot air to circulate freely. For best results, shake or flip food halfway through the cooking process.

Consider using the included rack or skewers to elevate food and promote even browning. Smaller food pieces may cook faster, so adjust cooking times accordingly. Proper preheating is crucial for consistent results. Avoid opening the basket frequently during cooking, as this releases heat.

Error Codes & Their Meanings

While the Power XL Air Fryer (models MFC-AF-6, MFC-AF-6C, MFC-AF-8) is designed for reliability, error codes may occasionally appear. Unfortunately, specific error code documentation isn’t widely available publicly. However, a general “Error” message often indicates a sensor malfunction or internal issue.

If an error occurs, first try unplugging the unit for several minutes, then plugging it back in. If the error persists, contact customer support with your model number. Avoid attempting self-repair, as this could void your warranty. Regularly maintaining and cleaning the unit can help prevent errors.

Safety Precautions

Always prioritize safety when using your Power XL Air Fryer (MFC-AF-6, MFC-AF-6C, MFC-AF-8). Ensure proper electrical safety by using a grounded outlet and avoiding damaged cords. Position the air fryer on a stable, heat-resistant surface with adequate ventilation – do not block air intake or exhaust.

Never overfill the basket, as this can cause food splatter and potential burns. Avoid touching hot surfaces; use oven mitts or tongs. Do not immerse the appliance in water. Supervise children when the air fryer is in operation. Disconnect from power before cleaning or storing.

Electrical Safety Guidelines

To ensure safe operation of your Power XL Air Fryer (models MFC-AF-6, MFC-AF-6C, MFC-AF-8), always plug it into a grounded electrical outlet. Never operate the appliance with a damaged cord or plug; replace immediately. Avoid using extension cords, as they may not be rated for the air fryer’s wattage.

Do not expose the electrical components to water or other liquids. If the air fryer malfunctions or gets wet, disconnect it from power immediately and seek professional repair. Ensure the voltage of your outlet matches the appliance’s rating. Never attempt to disassemble or repair the air fryer yourself.

Proper Ventilation & Placement

For optimal performance and safety with your Power XL Air Fryer (MFC-AF-6, MFC-AF-6C, MFC-AF-8), place it on a stable, heat-resistant surface with adequate airflow. Maintain at least 6 inches of space around the sides and rear of the unit. Avoid placing it near flammable materials like curtains or paper towels.

Do not operate the air fryer under cabinets or near heat sources. Ensure the ventilation openings are unobstructed during use. Proper placement prevents overheating and ensures efficient cooking. Avoid using the appliance outdoors or in damp environments. Always supervise the air fryer while it’s operating.

Avoiding Overfilling & Food Splatter

To ensure safe and effective operation of your Power XL Air Fryer (models MFC-AF-6, MFC-AF-6C, MFC-AF-8), avoid overfilling the cooking basket. Overcrowding restricts airflow, leading to unevenly cooked food. Do not exceed the maximum fill line indicated in the user manual.

Food splatter is common during air frying. Use a small amount of oil, if desired, and consider using the included accessories like racks or baking pans to minimize mess. Regularly check and clean the interior to prevent grease buildup. Never immerse the appliance in water. Proper precautions prevent hazards and maintain optimal performance.

Advanced Techniques & Recipes

Elevate your air frying game with advanced techniques! Marinating and seasoning food before air frying intensifies flavors. Layering food strategically within the basket—non-breaded items below breaded—promotes even cooking and crispiness for models MFC-AF-6, MFC-AF-6C, and MFC-AF-8.

Explore online resources for a wealth of Power XL Air Fryer recipes. Experiment with different temperatures and times to perfect your favorite dishes. Consider utilizing the Power BI integration (January 2026 update) to analyze cooking data and refine your recipes for optimal results. Unlock the full potential of your appliance!

Marinating & Seasoning for Air Frying

Maximize flavor with proper marinating and seasoning! For optimal results with your Power XL Air Fryer (models MFC-AF-6, MFC-AF-6C, MFC-AF-8), marinate meats and vegetables for at least 30 minutes, or even overnight, to enhance tenderness and taste. Dry rubs work exceptionally well, creating a crispy exterior during air frying.

Remember that marinades containing high sugar content can burn easily, so monitor closely. Seasoning blends should be applied evenly. Utilizing data analysis through Power BI (January 2026 update) can help track seasoning preferences and cooking outcomes, refining your recipes!

Layering Food for Optimal Results

Achieve consistently crispy and evenly cooked food by mastering layering techniques in your Power XL Air Fryer (MFC-AF-6, MFC-AF-6C, MFC-AF-8). Avoid overcrowding the basket; food needs circulating air for best results. For multiple layers, stagger items to allow airflow.

Smaller items should generally be placed on top. Consider using the included racks or skewers to elevate food. Analyzing cooking data with Power BI (PBIR format, January 2026 update) can reveal optimal layering configurations for different foods, improving your air frying efficiency and taste!

Exploring Online Recipe Resources

Unlock a world of culinary possibilities beyond the basics with readily available online resources for your Power XL Air Fryer (models MFC-AF-6, MFC-AF-6C, MFC-AF-8). Numerous websites and communities offer dedicated air fryer recipes, tips, and tricks.

Leverage these platforms to discover new flavors and techniques. Furthermore, utilize Power BI’s analytical capabilities (PBIR format, January 2026 update) to track recipe success rates and personalize your cooking experience. Data-driven insights can help refine your air frying skills and consistently deliver delicious results!

Power BI Integration (January 2026 Update ⎻ PBIR Format)

Enhance your Power XL Air Fryer (MFC-AF-6, MFC-AF-6C, MFC-AF-8) cooking experience with the January 2026 Power BI update utilizing the new PBIR report format. Track cooking times, temperatures, and recipe outcomes to optimize your air frying process.

The redesigned Power BI Desktop home screen provides a centralized hub for data analysis. Monitor your favorite recipes, identify trends, and gain valuable insights into your culinary habits. Leverage Power BI’s analytical tools to refine your techniques and consistently achieve perfect results, maximizing your air fryer’s potential!

Understanding the PBIR Report Format

While seemingly unrelated, the January 2026 Power BI update to the PBIR format mirrors the Power XL Air Fryer’s focus on streamlined efficiency. Just as PBIR consolidates report elements, your air fryer simplifies cooking. Think of PBIR as a ‘recipe’ for data – a structured format for insights.

Automatically converting existing reports, PBIR ensures compatibility and ease of use. Similarly, the Power XL (MFC-AF-6, MFC-AF-6C, MFC-AF-8) offers user-friendly controls. Both aim to enhance productivity. Analyzing cooking data via Power BI, using PBIR, unlocks optimal settings for crispy, even results – a perfect pairing!

Power BI Desktop Redesign & Home Screen

The redesigned Power BI Home screen, launching in January 2026, prioritizes a centralized, familiar experience – much like the intuitive control panel of the Power XL Air Fryer. This aims to boost productivity, mirroring the air fryer’s ease of use for quick meal preparation.

Discovering content becomes simpler, akin to selecting a cooking mode (Fry, Roast, Bake). Both interfaces focus on accessibility. The Power XL’s streamlined design parallels Power BI’s goal of enhanced workflow. Monitoring your business data mirrors monitoring your food’s cooking progress, providing quick insights and delicious results!

Utilizing Power BI for Data Analysis & Insights

Just as Power BI analyzes business data for actionable insights, understanding your Power XL Air Fryer’s performance yields optimal cooking results. Monitoring cooking times and temperatures – like tracking key business metrics – allows for precise adjustments. Rich dashboards in Power BI parallel the air fryer’s control panel, providing quick access to essential functions.

Get answers quickly, whether it’s identifying the perfect roast setting or pinpointing sales trends. Both tools empower informed decision-making. Analyzing data from previous cooks, similar to business analytics, improves future meals and efficiency!